Special events like the Major League Baseball (MLB) All-Star Game are back in full swing for most...

Published Articles

HSMAI | Keeping Tabs on Trends in the Industry - A 2022 Outlook

There’s no debate that the world has been transformed over the past three years. The pandemic has reshaped every facet of our lives, from mobilizing the global community’s collective response to crisis, to widening political divides, creating bumpiness in the economy, and more specifically, upending the hotel industry.

As 2022 progresses the travel outlook will remain generally positive. As a whole, the industry has rebounded more quickly than initially anticipated, although this has evolved differently than expected. The recovery has seen a significant increase in leisure travel, with longer visits and more shoulder night stays on Sunday and Thursday. The past reliance on higher-rated commercial transient and group business may be permanently altered. Along with these encouraging trends in length of stay and day of week patterns, the average daily rate has rebounded and is experiencing healthy growth. Leisure demand especially is driving the overall ADR performance across the U.S., although recovery and performance vary widely by market type and chain scale.

Why Market and Business Mix Matter — Now and in the Future

U.S. hotels have experienced varying degrees of recovery since the first precipitous decline in 2020 at the onset of the pandemic.

It’s important to consider market type in the recovery conversation, as it is tied to chain scale. Market types with more supply in economy and midscale chain scales are experiencing a similar boost in early recovery as the chain scales themselves; namely, rural area/interstate and small city/town. These markets are less dependent on a commercial base and have consistently outperformed markets where corporate and commercial group dominate.

Markets defined as large metropolitan areas (the top 50 markets), traditionally home to more upscale, upper upscale, and luxury chain scale hotels, will experience growth in RevPAR Index at a faster rate than other market types. This is due to an expected improvement in commercial transient and group business throughout 2022, compared to lagging growth in 2021.

Despite the glimmer of hope in terms of increasing and returning corporate and group business, markets within a three-to-five-hour drive of these major markets will continue to over-index on leisure business until commercial transient and group business fully returns. Resorts, particularly those with year-round appeal, generally fared better than seasonal destinations. “The composition of supply in the top 50 large metro markets will start to see recovery when traditional business travel becomes a larger part of the mix,” said Mark Lomanno, Kalibri Labs senior advisor. “However, the highway and small town locations have enjoyed a healthy recovery already through 2021.”

The driving force for the recovery continues to revolve around a market’s dependence on commercial business

Kalibri Labs forecasts that all U.S. chain scales will fall short of 2019 levels by about 20%. However, this business isn’t evenly distributed. Markets that relied heavily on individual business travelers and groups may take another two years to recover, while those with more local and regional business have either already recovered or will come close to 2019 levels by the end of 2022. On the other hand, leisure business surpassed 2019 levels by mid-2021 and will continue to outperform the commercial contribution. The less commercial business contributes to a market, the quicker it will recover to 2019 performance levels.

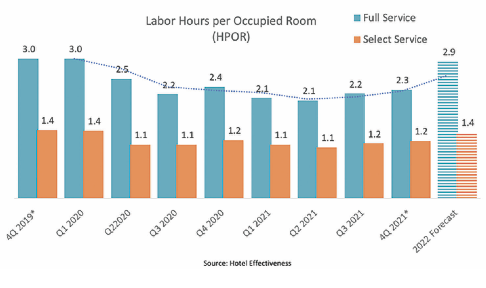

This shift in business will continue to have an impact on staffing, especially in guest-facing positions like housekeeping and front desk. Labor costs are an important factor to consider in evaluating the costs and benefits. Cuts in food and beverage and elimination of stayover cleaning led to a huge drop of labor requirements for hotels at the start of the pandemic. This equaled about a third of labor, said Del Ross from Hotel Effectiveness. “Then the leisure travel kicked in in 2021, and we started to add back in services. Hours per occupied room declined due to staff shortages, not a huge growth in efficiency. The uptick we’re experiencing in HPOR is going to continue through the end of 2022. This is a big deal, because we need to budget for it to avoid being short staffed again, or we’re going to be closing rooms and restricting hours because they can’t be serviced.”

This view of labor hours per occupied room (HPOR) demonstrates a return to pre-pandemic levels of HPOR by the end of 2022 for both full service and select service hotels.

Trends That Will Continue to Shape the Future The shift in overall business mix to heavily leisure from commercial transient or group may persist for the next few years.

How is your team working with these trends now? How will they do so in the future?

- Contactless/touchless travel: A growing trend before the pandemic, concern over spreading the novel coronavirus or other germs, has resulted in the evolution of a mobile-first approach to travel. Beyond the brand or organization standards you’ve implemented, what are some other innovative ways you can continue to support travelers in their quest for as little direct contact or touch as possible?

- Design for different types of travelers: The work-from-anywhere movement is growing, especially in the U.S. As more companies become fully distributed or work toward creating a hybrid model to offer competitive flexibility to employees, travelers will seek more than a standard desk workspace in their rooms and hotel public spaces. Designing, or in some cases, re-designing critical guest areas to be work-from-anywhere friendly will be a necessity for most hotels in the future.

- Maintaining a competitive edge as an emerging market: One of the most important and unexpected outcomes of early stage recovery was the surge in business to secondary and tertiary markets. As travelers emerged from lockdown and quarantine, they sought drivable destinations for a change of scenery. In many cases, this led to a significant discovery of closer-to-home locations more travelers want to explore.

- Stay flexible and update your strategies: An additional concern for the potential shift away from secondary and tertiary markets is keeping hotels relevant and visible. A 2019 study of business listings by Search Engine Watch found that “96% of all business locations fail to list their business information correctly.”1 In some ways, the pandemic has spurred necessary attention to business listings as hotels work to keep travelers updated on hours of operation, mask and/or vaccination requirements or recommendations, and local policies.

Perhaps more importantly, the study found most businesses were not optimized for voice search. The cost of not optimizing will grow each year as more and more people adopt this technology. Some studies suggest that as many as one third of all U.S. adults would use a voice assistant or search monthly2. This means that on top of updating business listings for physical search engines, you must also optimize for voice search. Voice is not a dying channel of production.

Lastly, a trend that’s here to stay is having a library of working and easily adaptable strategies to adjust your business to ever-evolving industry and traveler trends. Don’t be quick to assume that we’ve experienced truly unique situations over the past several years. We recommend tracking the strategies you implemented and their success rates. That will allow you to redeploy or repurpose them in the future.

Successful commercial strategy teams will deploy an operational framework, supported by a regularly updated playbook, to be prepared for what comes next.