Hotel demand is shifting once again, growing beyond its '21/22 themes. For the last 18 months, we...

Blog

Same Ingredients, New Recipe

Cooking Up Plans for a New Mix of Business

Do you have a favorite recipe? Maybe it’s one that’s been in your family for years, or one that you tweaked just perfectly to fit your family’s tastes and preferences. What ingredients do you use? How long does it cook or bake? You probably could write it down from memory.

For so many years, that’s how it was for the U.S. hotel industry in terms of business mix. Every hotel had found their perfect (or near-perfect) recipe for success, targeting a specific mix of business between Group and Transient or Commercial and Leisure each year. With growth expected year after year, it started to get more difficult to find higher quality ingredients, but it was still written into the sales & marketing plan to target them -- with a focus on higher ADRs in specific segments like Corporate and Group, and targeting bookings through lower-cost channels to impact and improve profitability.

Cindy Estis Green, CEO & Co-Founder of Kalibri Labs recently told HSMAI in an interview, “The industry had a long upcycle with 17% growth in guest paid revenue over the last 5 years. Business was good, and everybody figured, ‘Why should I change anything if we’re making a lot of money and it seems to be going well?’ But, like many other industries, the hospitality vertical has been intermediated by large digital tech platforms aggregating consumer demand and it has caused major upheaval for many such as retail, publishing and financial services. On top of digital disruption, the pandemic forced everyone to pay attention to everything again as though it was a clean slate: ‘Wait a minute, we can’t necessarily operate the way we have been. There’s no autofill on my hotel anymore, so I have to understand the composition of demand.’” While leisure business returned to pre-pandemic levels by June 2021, at that time, Commercial segments were under half the 2019 volume (49%) with a lot of uncertainty around when businesses would allow individuals to hit the road and when groups and meetings will resume.

Understanding the Ingredients of Demand

In response to the critical need to monitor the return of commercial business by market and submarket, Kalibri Labs has identified the segments that comprise commercial demand include Corporate, Government, Consortia, and Rack/BAR and Loyalty Member Rates on weekdays, while Commercial Group includes Association, Convention, Corporate, and Government. Segments that make up Leisure demand are all discount programs (AAA/AARP, Advance Purchase, etc.), Promotion/Packages, weekend Loyalty Member Rate, and OTA.

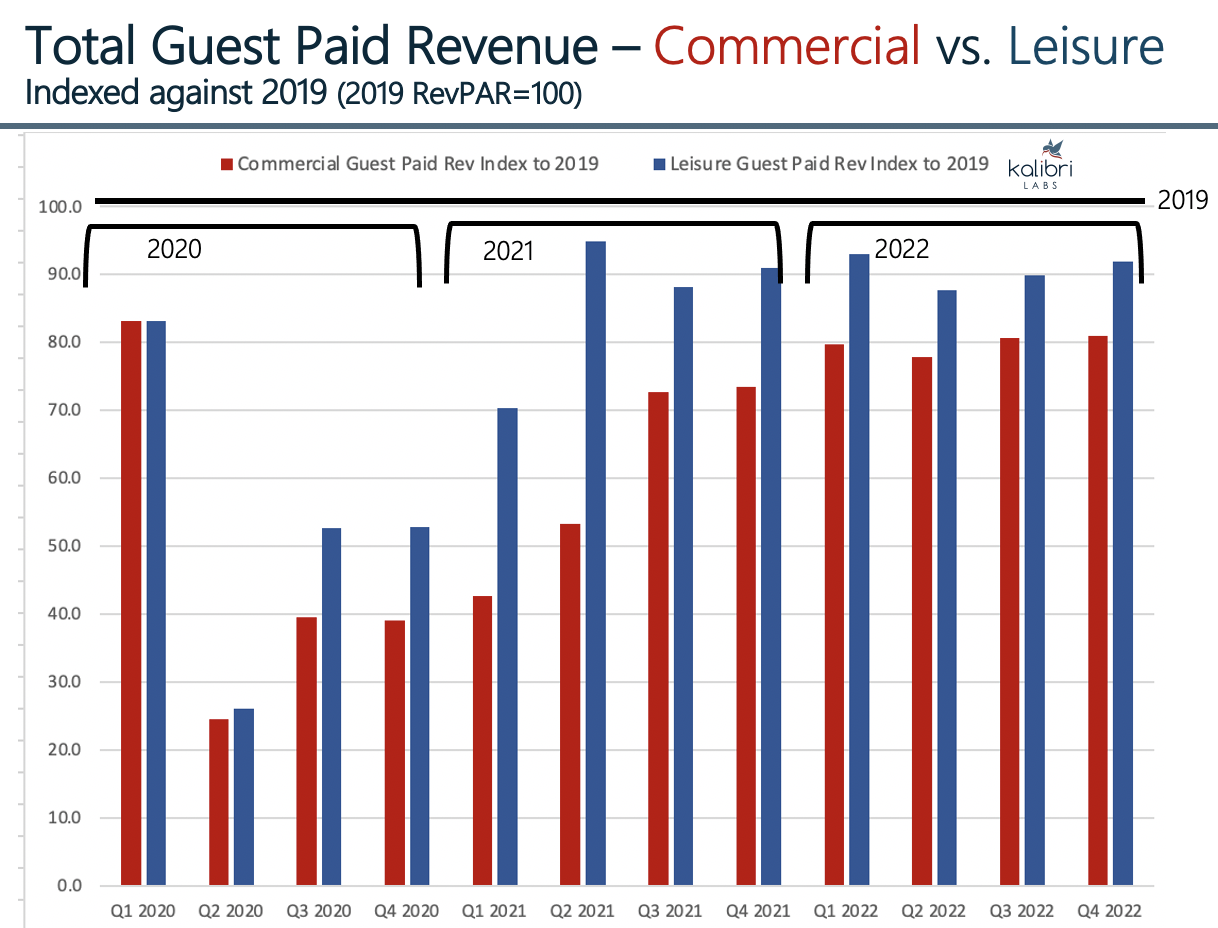

The composition of demand in 2019 for total revenue was 53% Commercial and 47% Leisure. For Group in 2019, Commercial contributed over two-thirds of demand (67.4%). The impact of the pandemic caused a 64% decline in total Commercial business and a 47% decline for Leisure. The loss in the commercial portion of total group demand was even more significant, declining 80% compared to 2019. It is clear that although Leisure business returned sooner, it will likely plateau at close to 2019 levels by the end of 2021. Commercial business will slowly return, but may still only reach 70-80% of its pre-pandemic volume by the end of 2022.

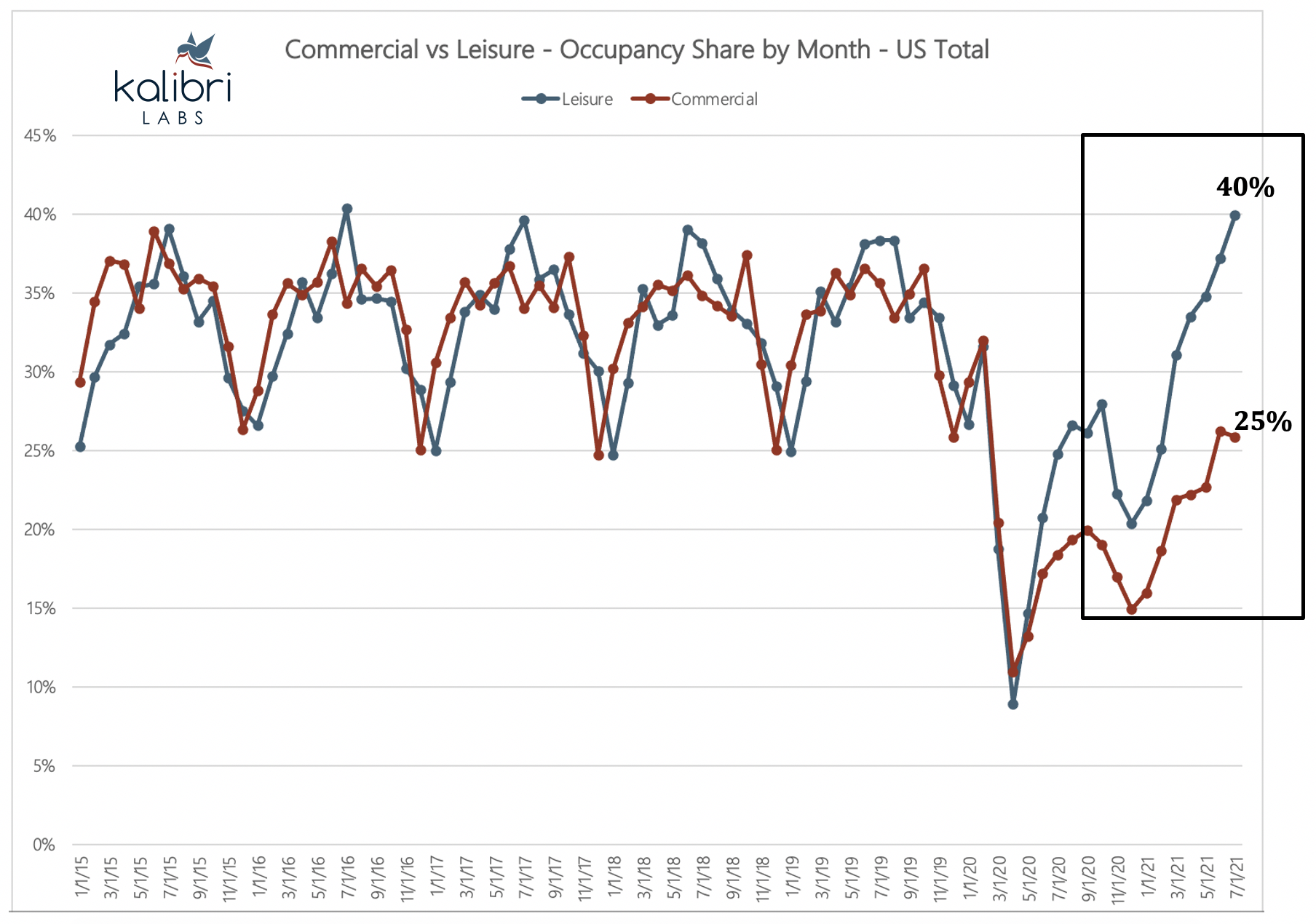

The initial 2021 recovery began for both Commercial and Leisure on a similar trajectory, but Q2 2021 experienced a significant boost in Leisure occupancy while Commercial never really took off. By mid-September, 2021 across all U.S. hotels, only 25 points of occupancy were contributed by commercial segments, with 40 points coming from leisure segments. U.S. markets vary dramatically in their pre-pandemic mix, and now, as a result of those differences, the recovery is very uneven in the pace and composition of demand.

While these trends represent the total U.S., performance by chain scale is most influenced by the market and submarket where the hotels are located. Even within a market, the spectrum of business volumes in each submarket can vary widely.

Commercial vs. Leisure Occupancy Contribution by Month, Kalibri Labs

Many lower and mid-tier hotels are in markets with an historically lower reliance on Commercial demand and many of these markets have already met or exceeded their 2019 performance, while dependence on Commercial increases for many Upscale, Upper Upscale, and Luxury hotels in markets with a higher mix of Commercial transient and group business. Forecasts for lower and mid-tier hotels are getting very close to 2019 levels, while Upper tier hotels in the large metro areas will be the last to return to pre-pandemic volume.

Read the full article on Hospitality Upgrade.