By: Cindy Estis Green, CEO & Co-founder

Blog

A Look at How Consumer Behavior Affects Acquisition Costs

By: Mark Lomanno, Partner & Senior Advisor

Featured on Hotel Management

With the advent and acceleration of the digital age, consumers continue to adjust their behavior, approaching even hotel booking differently. Whereas in the past most guests tended to book their room reservations directly with the hotel by calling or going to the property directly, now consumers are much more likely to shop for and buy their rooms online or on a mobile device. For a hotelier, the shifting consumer behavior from one booking channel to another can have a dramatic effect on the property’s bottom line, as each booking channel comes with its own associated costs. Understanding the impact of shifting channels is key to managing a hotel’s cost of customer acquisition.

Today, direct booking channels are defined as reservations through brand.com, voice or directly to the property. By comparison, indirect booking channels are reservations that come through online travel agencies, global distribution systems and fully independent traveler wholesale. Group bookings are the only major booking channel where reservations can be booked either directly or indirectly.

In the past five years, hotel booking patterns in the U.S. have shifted significantly toward indirect bookings rather than direct bookings. Since 2011, the ratio of direct bookings to hotels has declined from 4.2 direct bookings for every indirect booking, to now 2.8 direct bookings for every indirect booking as of June 2016. That shift represents a 33-percent decline in the direct booking ratio in just over five years.*

(*Note - this analysis covers all the hotel segments except economy chains, as data for that segment was not fully loaded at the time of this writing.)

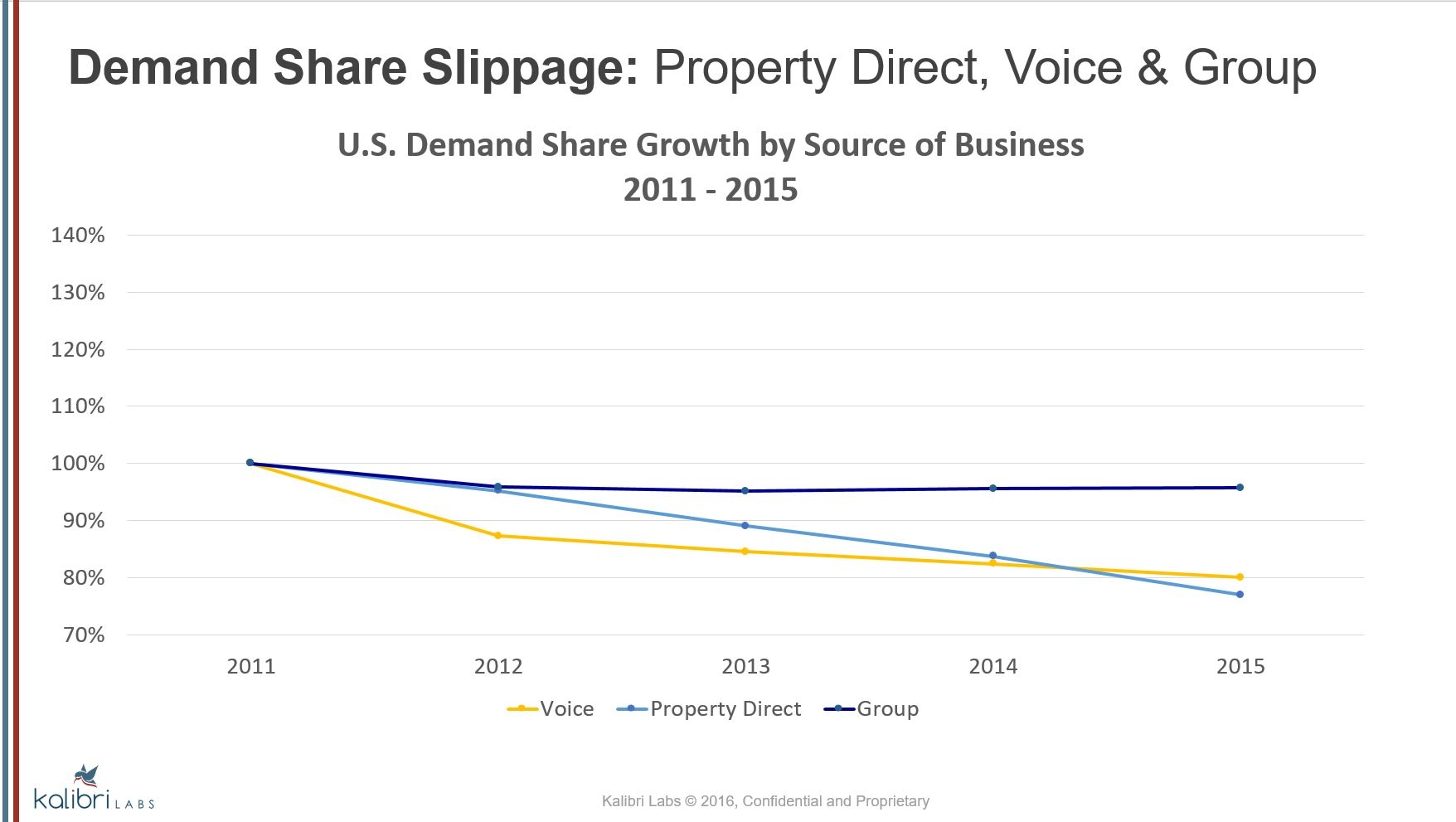

Which channels have lost share of total bookings over the past five years? There has been a noticeable decline in the percentage of hotel room bookings that have either gone through the voice channel or directly to the property. (See Figure 1.) This decline aligns with the increasing comfort of most consumers to use digital methods to book, as consumers now have more flexibility in the booking process. It is important to note however that overall room demand has increased in the U.S. in each of the past five years, so the absolute number of bookings does not show as pronounced a decline.

By contrast, the share of group bookings has only declined slightly over the same time period, and has actually been about flat since 2012.

Figure 1

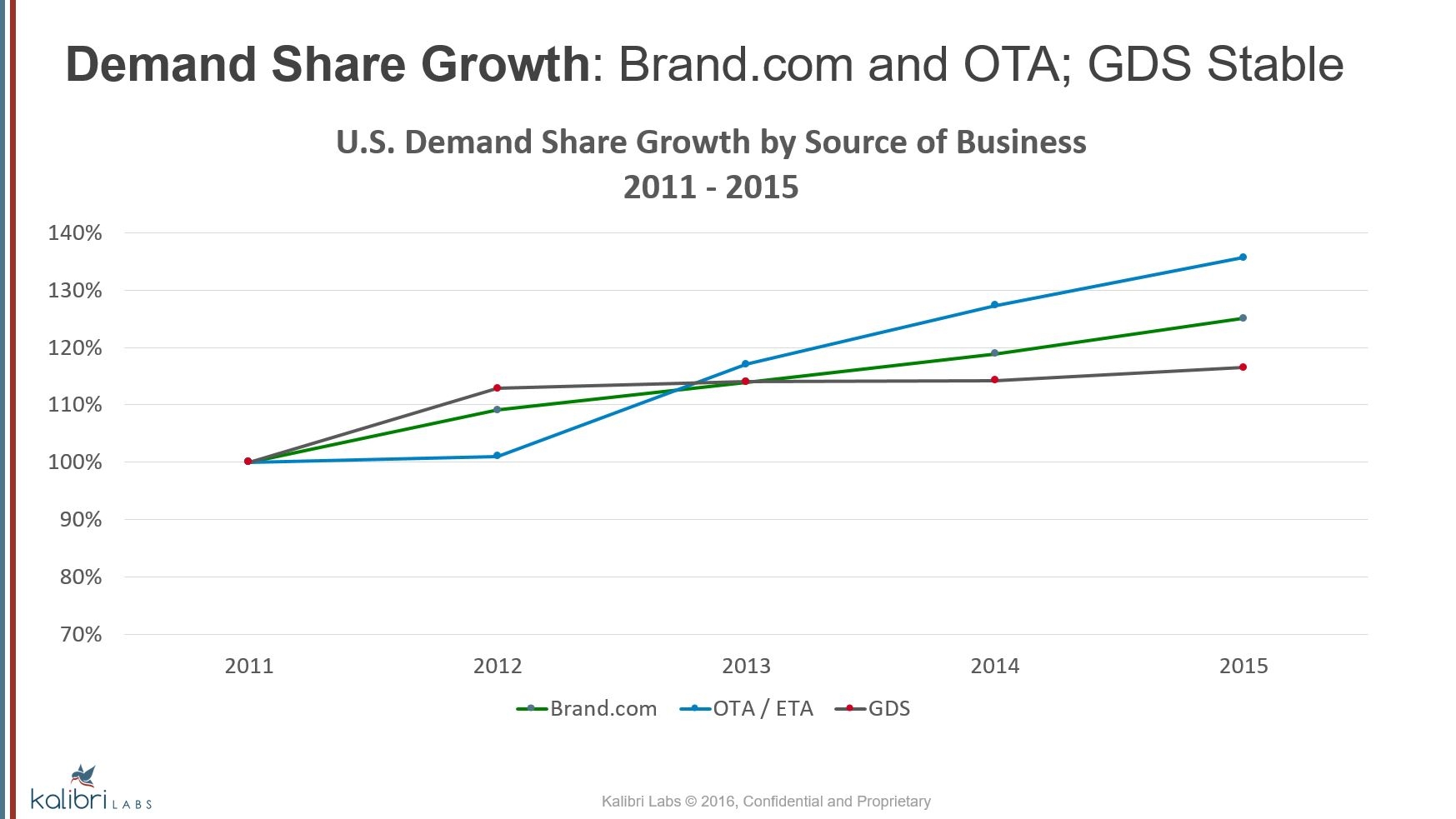

Conversely, several booking channels have shown explosive growth since 2011. Brand.com, OTA and GDS booking channels all have a substantially greater share of total bookings than they did five short years ago. That growth has been led by Brand.com and the OTA’s, both increasing more than 20 percent over the time period. The GDS share has also increased but not at nearly the rate of the other two digital booking methods. There is no reason to expect this shift in booking patterns to change in the next few years, but it will be interesting to see if there is continued acceleration in the growth of these channels or whether the growth rate subsides or plateaus. As a point of reference, the digital channels of Brand.com, OTA, and GDS represented about 44 percent of all room bookings in 2015.

Figure 2

As channels continue to shift along with consumer behavior, it’s important for hoteliers to monitor these shifts and understand the cost implications associated with each of these channels. The strength of Brand.com bookings is encouraging, as reservations through Brand.com are the most financially beneficial for the hotels; the costs are considerably lower when compared to both GDS and OTA channels which incur a significant commission. As the economic climate changes in the next few years, as it is certain to do, understanding and managing a hotel or portfolio’s channel mix will become an increasingly important discipline.

Mark Lomanno is a partner and senior advisor at Kalibri Labs, a next generation benchmarking platform for hotels operating in the digital marketplace, evaluating and predicting revenue performance at the industry, market and hotel levels. In addition to his role at Kalibri Labs he also advises several start-up and venture capital firms in the hospitality and data space as a member of the board of directors and advisors providing strategic direction and building industry relationships. Lomanno is the former president and CEO of Smith Travel Research.